ETFs, or Exchange Traded Funds, have become a popular choice for investors in Australia. These financial instruments offer a way to diversify portfolios without the need to buy individual stocks. As the finance world continues to evolve, more and more Australians are considering ETFs for their investment strategies. This tool combines the features of a stock and a mutual fund, offering instant diversification and risk management.

In recent years, ETFs have gained traction among both novice and experienced investors in the country. Their appeal lies in their ease of use, cost efficiency, and the range of investment options they offer. With the growing interest and accessibility of the market, ETFs are setting new benchmarks in the Australian financial ecosystem.

Understanding exchange traded funds in Australia

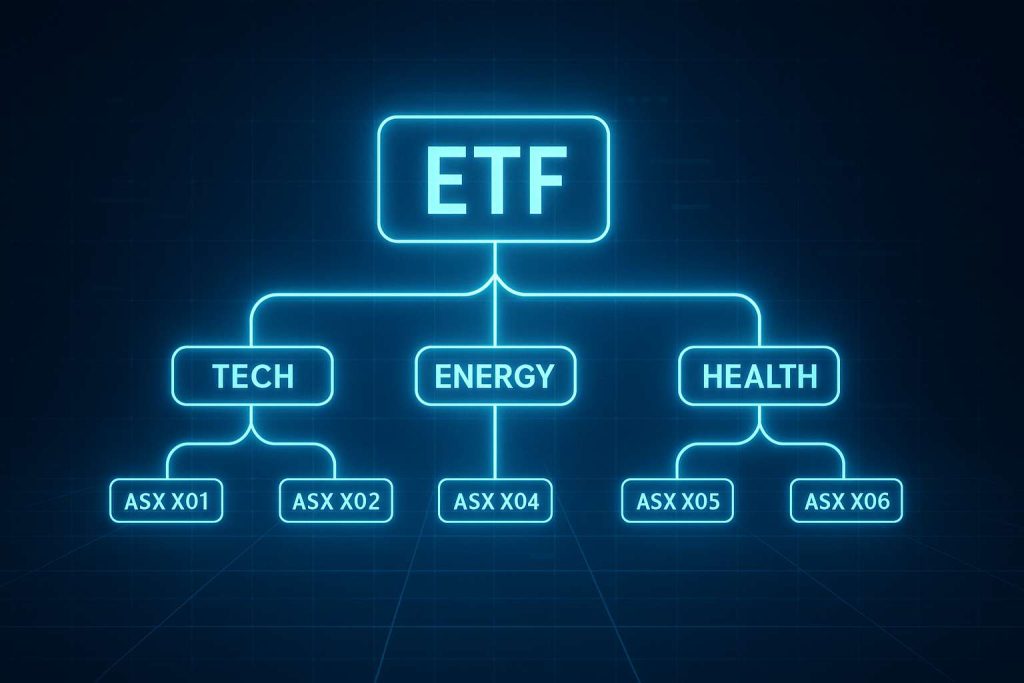

To comprehend why ETFs are becoming increasingly attractive, one must first understand what they are and how they function in Australia. Essentially, ETFs are investment funds traded on stock exchanges, similar to stocks. They hold assets like stocks, commodities, or bonds and usually track an index. This structure allows investors to buy and sell them throughout the day, offering flexibility.

In Australia, the ETF landscape is diverse, providing a wide array of options catering to different investment goals. From the Australian Securities Exchange (ASX), investors can access numerous ETFs that cover various sectors, indices, and investment strategies. This diverse offering helps investors tailor portfolios according to their financial objectives and risk tolerance.

The mechanics of ETFs in the local market

The mechanics of ETFs are straightforward yet impactful, especially in Australia’s dynamic financial market. Investors acquire shares of an ETF, which in turn invests in a basket of assets, thus diversifying risk. This pooling of resources allows even small investors to access a wide market domain, which might be out of reach individually. Moreover, the operational costs associated with ETFs are generally lower than those of traditional mutual funds.

Key benefits of investing in Australian ETFs

Investing in Australian ETFs offers several compelling benefits. The primary advantage is diversification. By investing in an ETF, investors can spread their risk across multiple assets rather than relying on the performance of a single stock. This diversification is crucial in managing and mitigating risks in volatile markets.

Another benefit is liquidity. ETFs are traded like stocks on the ASX, allowing investors to buy and sell them throughout the trading day at market prices. This feature provides flexibility and the potential for strategic investment moves. Additionally, they are available for a broad spectrum of sectors and themes, allowing investors to align their portfolios with both local and global economic trends.

Implementing ETFs in your investment strategy

For investors looking to incorporate ETFs into their strategies, it is essential to identify financial goals and risk appetite. By understanding one’s needs, choosing the right ETF becomes more straightforward. Analyzing the underlying assets and performance history of the fund will guide decision-making. Utilize ETFs to complement your portfolio by filling gaps in asset allocation or gaining exposure to specific industries or markets.

The growing attraction of ETFs

In conclusion, the rise of ETFs in the Australian market is a testament to their adaptability and efficiency. They cater to a wide array of investment styles and objectives, providing solutions for both risk management and growth potential. As more Australians become financially savvy, the shift towards ETFs is expected to continue.

For many investors, ETFs represent a balanced approach to building wealth over time. With the potential for a good return, combined with the benefits of diversification and liquidity, ETFs are likely to remain a cornerstone of the investment strategies in Australia. Whether beginner or seasoned investor, ETFs offer a practical avenue for engaging with the market.